Everything Your Child Needs to Know About Money Before Leaving Home

When it comes to teaching money, you may be wondering what to cover with your kids. This guide includes everything children need to know about money.

** As an Amazon Associate I earn from qualifying purchases. **

Did you feel well-prepared to face the grown-up world of finances, bills, and expenses?

According to a small group of my friends, they didn’t. Leaving college and entering the “real world” this group of women didn’t know how to budget, live within their means or understand the basics of a home mortgage. And investing? Not even sure where to begin.

With little financial literacy taught in schools, these women aren’t alone. According to a Gallup Poll two-thirds of adults worldwide are financially illiterate. Compounding this problem is ignorance of what we don’t know and should.

Teaching Money: 11 Essential Lessons for Kids

Below is a list of some of the most important money lessons you should cover with kids when teaching money. Let it serve as a guide for your children as you prepare them for adulthood.

Mindset is everything

The first step to financial freedom is having a money mindset of freedom, not enslavement. Understand that the more you live within your means, are careful with a budget, and save for the future, you will control money and money won’t control you.

Help kids understand this with your example. Or if you’ve made money mistakes in the past (or even the present) – be open with kids about why you would do things differently. Parents are their kids most important source of financial information and the more we consciously talk to our children about money the better prepared they will be as adults.

Set financial goals

Saving money is BORING. What’s the point of putting money aside each month if you could spend it instead? That’s why it’s important to set financial goals and get in the habit of saving. These goals could be as lofty as buying a house in five years to paying for a cross-country road trip next summer. Aspirational goals help motivate us to save and avoid taking on burdening debt when the time comes to fulfill these dreams.

Have kids set their own financial goals with this Savings Challenge Sheet that allows them to write down a goal and determine how much to set aside each week to achieve it. These small exercises will lay the foundation for knowing how to reach financial goals as an adult.

Budgeting

Just like saving, budgeting can be a snooze. That is unless we see the bigger picture. Keeping track of how much money we spend versus bring in each month helps us get a grip on where we stand financially.

Even though kids’ expenses are small, there are ways parents can introduce the idea of budgeting. For example, a clothing allowance taught me the importance of budgeting. Younger kids can also keep track of their spending with the My Spending sheet featured in this post.

The Kids Money Management Toolkit has everything you need (except money!) to begin giving your kids an allowance. In addition to guidance and advice, you’ll also receive Save, Spend, and Share jar labels, a Kids Money Ledger, a Savings Challenge Sheet, a Jobs-for-Hire Sheet, and a Kids Allowance Contract. Click here to learn more.

Resist comparison

A big stumbling block to achieving financial goals is the thought, “If they can afford that I can too.” or “All of my friends have this so I deserve it too.”

The truth is you have no idea how these friends have paid for their expenses. Did they take on debt? Are they without savings? Most of the time other people are not a good yardstick for how you should spend your money, especially if their financial goals and mindset are different.

Kids frequently make comparisons with their friends. When it comes to purchases made by parents (“Sara got an iPad!”) explain to them that different families make different spending decisions and that’s OK. Even though Sara’s family felt comfortable buying her an iPad, your family does not and then state the reasons why.

Be mindful of debt – even college debt

Most people understand that debt can be debilitating, but few keep this in mind when it comes to college. Today it’s not just a matter of choosing the right college academically but also determining how to take on the least debt.

In his book, There is Life After College, Jeffery Selingo writes that college graduates who are most successful after school – a group he calls “Sprinters”, have little or no student debt. This lack of debt burden frees these graduates to pick job opportunities without being limited by pay and they are more financially able to take career risks such as starting a business.

If going to a less expensive, less prestigious school sounds like a hindrance to success, you’ll want to check out the book Where You Go is Not Who You’ll Be, by Frank Bruni.

In any case, it’s important to educate teenagers what it means to take on a debt burden after school. This can be challenging given teens’ limited financial education, but this video is a great resource for parents to explain to teens how loans work.

What credit cards are and how they work

I’ll never forget a friend who acquired a credit card in college without understanding how it works. She thought paying off the minimum due each month was enough. It wasn’t until later she realized the total amount owed was snowballing with interest payments leaving her with unexpected debt.

Parents have a responsibility to at least explain the basics of how credit cards work to their kids. It might even make sense to let your teen have their own card while they’re still at home so you can coach him or her on the best way to use credit cards.

This guide can help parents determine if giving their teen a credit card makes sense: Should You Give Your Teen a Credit Card?

Invest early and often

The thought of investing money can be daunting to the uninitiated. And who has time to research not only how the stock market works but what to invest in?

But in today’s world, adults need to have a basic knowledge of investing since it’s typically up to them to fund their retirement accounts.

If you feel lost in the world of investment products, keep it simple when teaching your kids. Index funds are a simple solution to investing in stocks or bonds and a great first place for your son or daughter to begin.

This article is a good introduction to index fund investing: These Five Index Funds Are All You Need.

To give kids a deeper understanding of the stock and bond markets, the following investment books are written for kids:

Don’t put off retirement savings

Learning the basics of investing is half the story when it comes to saving for retirement. Another valuable lesson to pass on to kids is that the sooner they start saving, the less they’ll have to set aside over their lifetime.

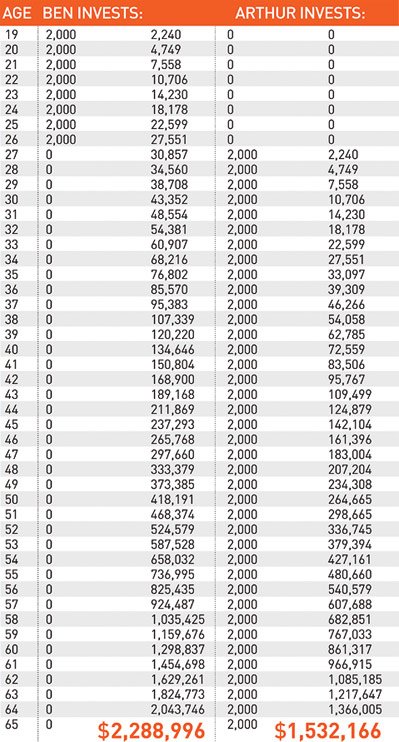

This chart from Dave Ramsey shows the impact of compound interest during the lives of two very young investors. Note that even though Ben invested only 8 times while Arthur invested 39 times, Ben still accumulates larger total savings since he began investing early.

And don’t forget to alert kids to matching retirement plans when they begin their first job. That’s free money in addition to salary and means an even greater impact on total retirement savings.

Have an emergency plan

What happens if you suddenly lose your job and have bills to pay? Or find yourself in need of $1,500 in car repairs?

Many financial advisors suggest that putting 3-6 months salary in a simple savings account can provide a cushion from these unexpected expenses.

Most young adults don’t realize this until it’s too late – until the first unexpected bill arrives – and then they turn to a credit card to cover the cost. Perhaps the best time to talk to kids about the need for emergency savings is when your family finds itself in need of extra cash. Money lessons are more likely to sink in in the context of real life.

Insurance

Most adults are well aware they need insurance to avoid a major financial catastrophe. Auto, health, renters or home owner’s insurance are all valuable instruments and often well worth the cost each month.

Recent graduates, however, might see renters insurance as a burden and not understand its significance. They also may not understand the importance of researching health insurance options.

Parents can teach kids about insurance by simply talking about the insurance they own and why. The Texas Department of Insurance also has a kids page that explains the most common insurances in simple terms.

Preparing for the future

While we hope to send our kids off into the world fully-equipped to handle whatever financial challenge comes at them, the reality is there’s not enough time to cover everything.

Even as an economics major and business minor I still had questions about how best to manage my finances in my early 20s. One of the most helpful resources I found was a book called Get a Financial Life, by Beth Kobliner.

In plain and simple language, Kobliner covers the basics of banking, debt, investing, insurance, taxes, and home mortgages. The book serves as a great guide to recent graduates who may still need simple guidance on complex topics. There’s even a chapter called “Crib Notes: a cheat sheet for time-pressed readers who need help now”.

Teaching kids about money and getting them ready for the future isn’t easy, but being aware of the lessons we can teach and discuss is a first step to helping prepare our kids for the world after graduation.

You May Also Like:

Kids Won’t Really Understand Money Until You do This

One Brilliant Thing My Parents Did That Turned Me Into a Money-Savvy Adult

About the Author

Kerry Flatley is the owner and author of Self-Sufficient Kids. She has a BA in economics, an MBA, a certificate in financial planning, and has been investing ever since she landed her first job. Kerry also has two girls, ages 11 and 13, who have been receiving allowance – and learning money management – for the past five years.