Everything You Need to Know About Giving Your Teen a Credit Card

Whether or not to give teens credit cards isn’t an easy decision. Here’s a step-by-step guide to determine if your teen should have a credit card.

(This post contains affiliate links. If you click on a link and make a purchase, I’ll receive a commission at no extra cost to you.)

Things change quickly once you have a teenager. First, they’re able to communicate independently with friends on their phone. Then all of a sudden your teen has a part-time job. And before you know it they’re pulling out of the driveway in the family car.

All these milestones inch our kids towards adulthood, but should giving a teen a credit card be among them?

Giving a teens a credit card means they can buy their own gas and have an emergency back-up. But it can also be viewed as an endless means of funding and the possibility of getting into debt.

So what should parents do?

There’s a lot to consider when giving teens a credit card. And the question isn’t necessarily is your teen ready to have a credit card but are you, the parent, ready?

The following is a guide to help parents consider if giving your teen a credit card is a good idea. Every teen and every parent is different, so the answer will be individual depending on your situation.

Determining if a credit card is right for your teen

“Some parents say they want to give their teen a card to teach them about credit. The card isn’t going to jump up and teach your kid anything. We have to stop expecting that just because a teen has a card they’re going to learn something,” says Laura Levine of the JumpStart Coalition.

So Laura suggests the question of readiness should really begin with the parent. “Are you, the parent, ready to put in the time and supervision necessary?”

She also suggests parents need to assess if their kids are knowledgeable and responsible enough to have a credit card:

“We all know some 15-years-olds who can handle credit cards and some 30-year-olds who cannot.”, Ms. Levine says.

The choice of whether or not to give your teen a credit card will be individual. And should be seen as a reinforcement of what your teen knows about money, saving, and credit – but not a lesson unto itself.

The benefits of giving teens a credit card

For some teens, a credit card can be a beneficial learning experience:

#1 – Parents can coach teens in proper use of credit: I’ll never forget a college friend who signed up for a credit card without knowing how it works. She soon discovered that by only paying the minimum due each month her debt was snowballing beyond what she could afford.

Giving teens a credit card in high school can educate them on how credit cards work and the pitfalls to avoid. With parents coaching teens along the way, teens will be in a better position to responsibly use credit cards once they leave home.

Fortunately, teens under eighteen can’t take out a credit card on their own. And anyone ages 18-21 needs a cosigner if they don’t have their own source of income. Sharing a card with your teen lets you see how they use the card and if they are paying off their monthly balances. Once your child is living on their own, you won’t be able to monitor your adult child’s use of credit.

#2 – Having a card as a teen can build a good credit history: Building good credit means the ability to secure a credit card in the future with a low-interest rate. It also also means being able to take out a car loan or secure a mortgage. In addition to teaching kids how credit cards work, parents should explain why building good credit is important.

Of course, the risk in giving teens their own credit card is that it could hurt their credit history. And if you’re their co-signer, it could also hurt your credit.

Your teen isn’t ready for a credit card if:

Your teen has zero money sense: Your teen probably isn’t ready for credit if they have no experience with money, they don’t understand the need to delay gratification or understand that money is limited. (See below for steps parents can take to prepare teens for money management)

You don’t have the time to coach them: You’d never hand over car keys to a teen without first teaching them to drive. And unlike driving, there are few opportunities to outsource your teen’s financial education. So be honest with yourself and determine if you’re really to teach your teen the right way to use credit.

Your teen is irresponsible: Every person and teen is different. If your teen has proven to be irresponsible in other areas of life, giving them credit is probably not a good idea. (But chances are you’ve already figured this out)

How to prepare teens for using credit cards

You’ve decided you’re ready to give your teen a credit card before they leave the nest – but not so fast…There are a few steps you should take first to prepare your teen for the responsibilities of having credit:

- Practice makes perfect: Before introducing the concept of credit, teens first need to understand money mangement. Giving kids an allowance can build an understanding of how money works and the importance of saving.

- Open a checking/debit card account: Having a checking and debit card account is an important first step before getting a credit card. Similar to an allowance, a checking account reinforces the concept of money having limits. Plus, your teen will need an account to pay off their credit card bills each month. Check out Greenlight or Copper Bank for easy debit/app tools that are specifically designed for kids and teens.

- Sit down with your teen and have the talk: It’s finally happened – you’ve determined your teen is ready for the responsibility of a credit card. But before you hand over the plastic, make sure to cover a few important details:

- Interest rates: Most cardholders get into trouble because they don’t understand how credit card interest accumulates. This article provides a very thorough visualization of how credit card interest is calculated: How Credit Card Interest Works

- How the credit card billing cycle works: Another mystery for new card holders is the credit card billing cycle. This video provides a good explanation: How the Credit Card Billing Cycle Works

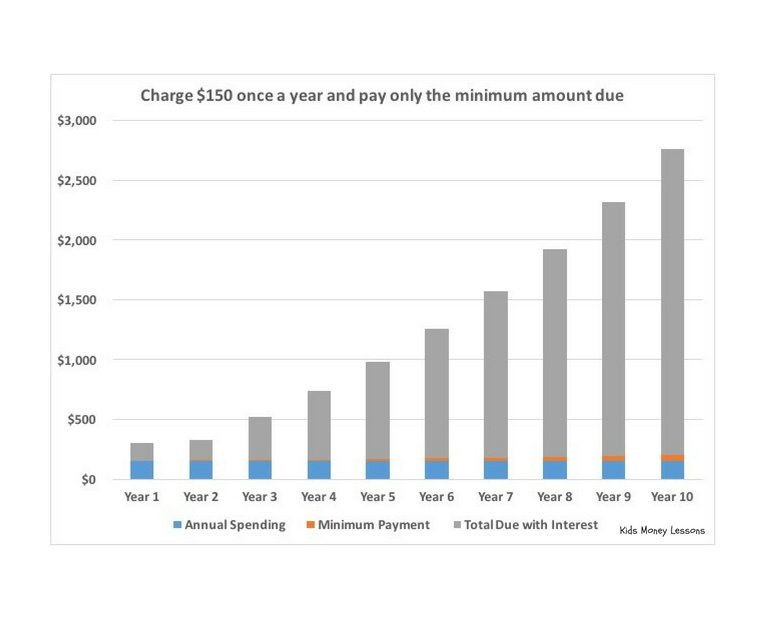

- Why it’s important to pay in full each month: The term “minimum payment” is a tricky concept. Without understanding of what it means, a teen might assume paying the minimum won’t result in any interest charges. But as the chart below illustrates, paying only the minimum can balloon into thousands of dollars in interest payments.

- Understand your card’s terms and limits: Parents need to educate their teen about the terms and limits of their card. The terms, rules, rates, and penalties of credit cards vary and it’s important to understand these differences.

- What a credit history is and why it’s important: Most newbie credit card users don’t understand credit history and why it’s important. This video explains how a credit score is calculated: What is a Credit Score?. It’s also worth pulling your teen’s credit score after a year or so and reviewing it together.

- The safe use of credit cards online: Talk to your teen about sites where it’s OK to use a credit card. Also explain that many websites are scams and can steal credit card numbers. This article explains 5 Steps to Keep Your Credit Cards Safe When Shopping Online. This is also a good time to talk about identity theft and the danger of sharing social security numbers online.

Tips for successfully teaching your teen the responsible way to use credit cards:

Now that your teen has a credit card, make sure you’re teaching them responsible habits:

- Have your teen pay the balance: Since your teen has a checking account, they should pay off their credit card balance each month. This also helps them see the connection between purchases made on their card and the aggregate due.

- Encourage teens to keep track of what they’ve charged: Have your teen keep a ledger of their purchases to determine how close they are to their monthly limit.

- Decide which items are acceptable to put on a credit card: Some families may want to make rules about what can and cannot be charged to a credit. Emphasize that teens should primarily pay through their checking account with a credit card considered a backup.

- Set a limit to how much can go on the card: Families may also want to set limits to the amount teens can charge each month. Finding a card with a low credit limit can help.

- Remember your teens are watching you: Setting a good example isn’t always easy but it can make a lasting impression. If you do make a mistake, talk to your kids about it and let them learn from it.

- Whatever you do – don’t bail them out: One of the most important steps a parent can take is to never bail out a teen. Of course, assuming all the steps above have been followed, any debt incurred isn’t likely to be catastrophic. And your teen should be able to pay it off with careful planning. Bailing out a teen won’t teach them the limits of money or the pitfalls of misused credit.

Related:

Everything Your Child Needs to Know About Money Before Leaving Home

A Super Easy Way to Give Your Kids an Allowance

What to do next…

1. Subscribe to Self-Sufficient Kids’ email list.

Like what you read here and want to learn more? Every Thursday I’ll send you one parenting tip about raising self-sufficient kids and creating the peaceful relationship you yearn to have with your child. Click here to sign up.

2. Take one of my quizzes!

Find out if you’re raising a self-sufficient kid (click here) or if you’re doing too much for your kids (click here). At the end of each quiz, you’ll be asked to provide your email address to see the results.

3. Get your kids started on chores.

Learn how to get your child started on chores (& keep them motivated + avoid power struggles) by enrolling in my Get Your Kids Successfully Started on Chores course. Click here to learn more and sign up.

Kerry Flatley is the owner and author of Self-Sufficient Kids. She has a BA in economics, an MBA, a certificate in financial planning, and has been investing ever since she landed her first job. Kerry also has two girls, ages 13 and 15, who have been receiving allowance – and learning money management – for the past seven years.